As I have chatted with folks around Great Falls over the past two weeks since the May 8th mail-in school district levy and Park District 1 election, folks have expressed some surprise that the school levy failed while the Park District proposal passed. I’ve wondered the same thing myself because the school levy was a…

Author: Rick Tryon

The Who, What, And How Of The Great Falls Good Old Boys And Gals Club

A local good old boys and gals club does exist in good ol’ Great Falls, and it has real impact on our community. Despite those who yell that I am just being negative, the facts tell the story. Crony capitalism exists to some extent everywhere and at every level, including right here in Great Falls….

Cascade County Sheriff Race Kerfuffle

There’s an interesting development in the Cascade County Sheriffs race between Sheriff Bob Edwards and one of his opponents in the June 5 Democratic primary. It first came to my attention when I saw that someone had shared Edwards’ May 4th ‘Retain Sheriff Edwards’ Facebook post following the KRTV sheriff candidates debate. In the post…

Little-Known Important Information For Great Falls Park District Voters

Did you know that if you own property in Great Falls but live outside the city limits you can still vote either for or against the new consolidated Park District 1 tax increase? I didn’t know that very significant piece of information and I’ve been a voter here for decades. Someone asked me about it…

An Arrogant And Out Of Touch City Commission

Doing some research recently on the local CDBG funding debacle I came across a couple of interesting exchanges from the June 20, 2017 Great Falls City Commission meeting which illustrates why so many folks consider our current city commission to be so out of touch with citizens. In this first short video Commissioner Bronson is…

Let The Sunshine In

Every week should be ‘Sunshine Week’ when it comes to informing citizens about what their local public officials are up to. E-City Beat has asked me to do some research and writing concerning the recent Community Development Block Grant conflicts of interest issues involving Department of Housing and Urban Development funds and the Great Falls…

Great Falls Mayor Kelly Dancing Around The Issues

Kudos are in order for Great Falls Mayor Bob Kelly. Well, sort of at least. At the 2/20/18 City Commission meeting, the Mayor apologized to citizens and to the organizations that won’t be receiving almost $200,000 in CDBG grants. Well, kind of apologized anyway. The reason that some local non-profit organizations will not be receiving…

Treasured Presidents Day Memories

This is a special time of year for me and my family. Presidents Day holds so much meaning and so many great memories for me even now as an adult. When I was a kid, every year my brothers and I, with barely contained excitement and anticipation, would count down the days until that magical,…

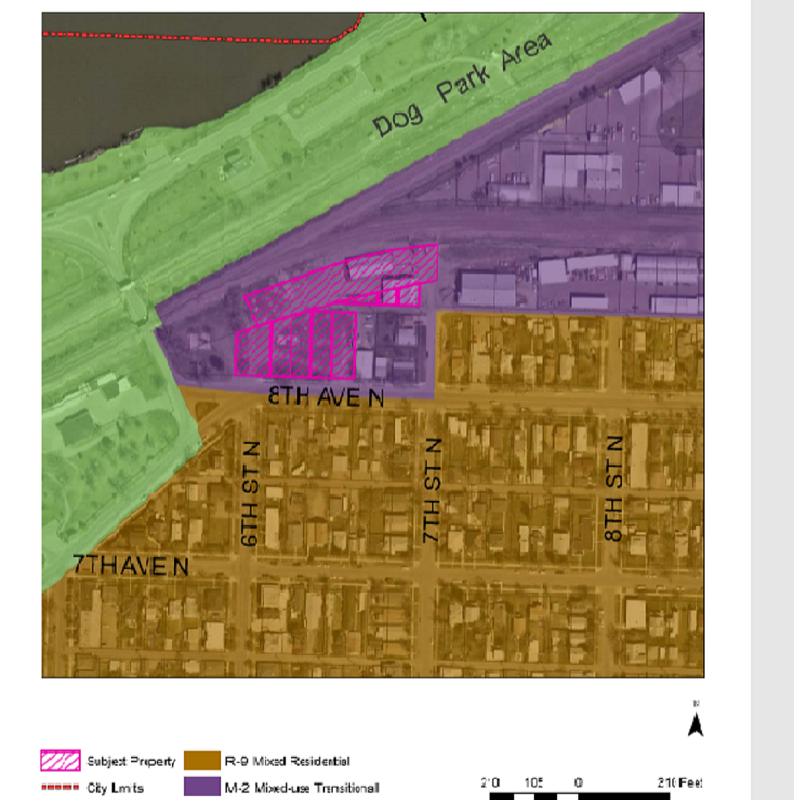

Cronyism And Great Falls’ No-Growth Policy

Is Great Falls business friendly? Does the City encourage growth? Why are these never-ending questions? Perhaps the answers are obvious after all. The Great Falls City Commission recently voted unanimously to deny a Conditional Use Permit (CUP) to locally owned and operated M&D Construction. City staff, the City Zoning Commission and Neighborhood Council 7 all…

No Brainer?

Kudos to Craig Raymond and his staff in the City of Great Falls Planning and Community Development Department for working to find solutions to help keep a local private sector employer, M&D Construction, in the heart of Great Falls. This is the attitude we need from our city employees across the board; not “You can’t…