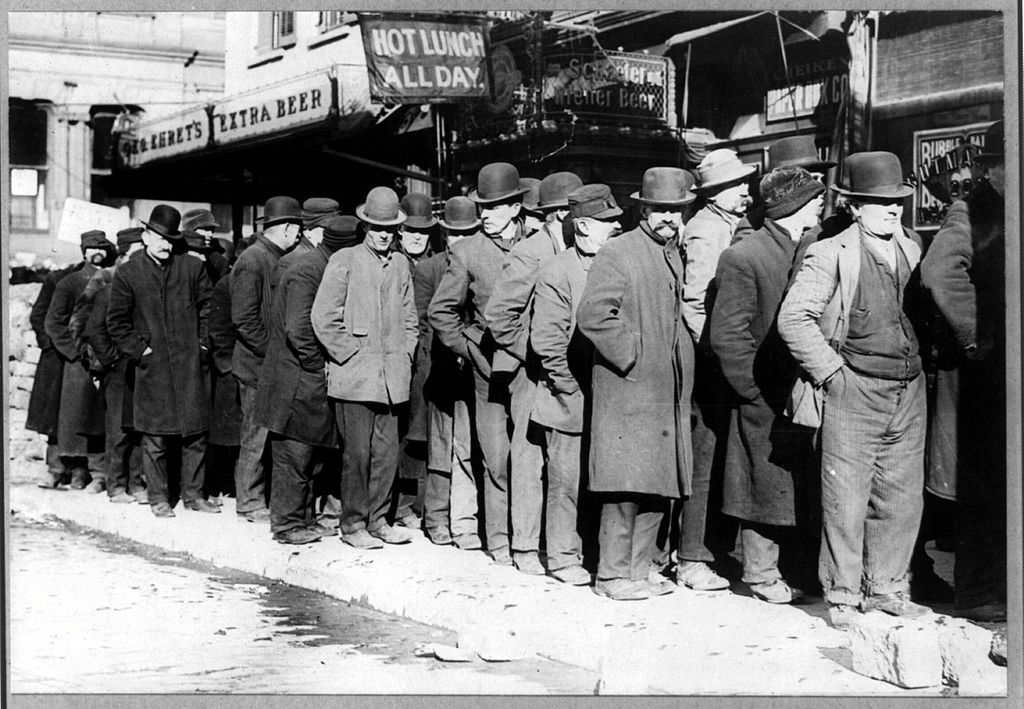

According to a tweet from Lee’s Holly Michels, unemployment in Montana has (predictably) skyrocketed, with 41,000 new claims filed in just Sunday and Monday of this week: Of course, this trend will only continue. People are hurting right now, here and everywhere else. Other Montana communities, like Bozeman and Belgrade, have opted to compassionately cancel…

Category: GFPS

School Board Candidate Q&A: Bill Bronson

I recently emailed all of the School Board candidates and asked them the following question: Q: In this time of crisis when residents are out of work, are you in favor of acting as Bozeman and Belgrade did by cancelling, or rescheduling the levy for a later time? E-City Beat will publish each of the…

Will Businesses Reject Great Falls If We Don’t Pass The School Levy?

In a recent letter to the editor, Gerry Jennings urged support for the upcoming school levy. After making a suspect claim about class sizes, Jennings regurgitated an even more questionable argument about public education and its relationship to economic development. “My four children received the best education the state had to offer during the ‘70s…

Pedal To The Medal

Is it time for the Great Falls Public School District to take their foot off the levy pedal and apply the brakes? It is apparent that the school district’s overpaid administrators and the local rubber-stamp school board are heading full speed ahead with guns blazing to take another $1.75 Million from the taxpayer’s pockets on…

GFPS Shell Game

Is the GFPS District really short of cash, or are their cries just a sleight of hand? If, as Mark Finnicum, a school board member who also serves on the board’s budget committee said, the $1.75M upcoming levy isn’t to add new programs or staff but “is maintaining what we already have” is true… …why…

School Tax

The Great Falls Public School District would like you to believe that the impact of the proposed $1.75M operational levy would result in a very small increase to your property taxes, $16.27 on a home valued at $100,000 and $32.54 on a home valued at $200,000. The fact is that the impact of the levy…

GFPS Levy Is 100% Not For ‘The Kids’

No, we are not talking about the graduation rate at the District’s two high schools, not even close. And we are not talking about the District budgeting acumen either. What we are talking about is how much of the proposed $1.3M operational levy will be going for raises for staff and administrative positions and increases…

Lying Is The New Norm

Although, lying has been around forever, it is now becoming a common practice by propagandists and pundits wanting to promote individual, or collective agendas. Straight-out lying has been destigmatized if it advances a certain propaganda that leads to what might be considered a worthy, or important goal. Whether the goal, or objective pursued is objectively…

The Good, The Bad, And The Ugly From GFPS

It is fair to say a large number of property taxpayers are opposed to voting for yet another school district levy. Based on recent school district levies, both those which passed, and those which have failed, it is also fair to say taxpayers have gotten the good, the bad and the ugly…

New School Tax, Same Old Song

With the coming of the new year comes another attempt by the Great Falls Public School District to raise your taxes. “What?”, you say, “We’ve just given them $98 million dollars and now they want more, $1.3 million more. For what?” Well of course, the school district will tell you it’s for the kids, but…