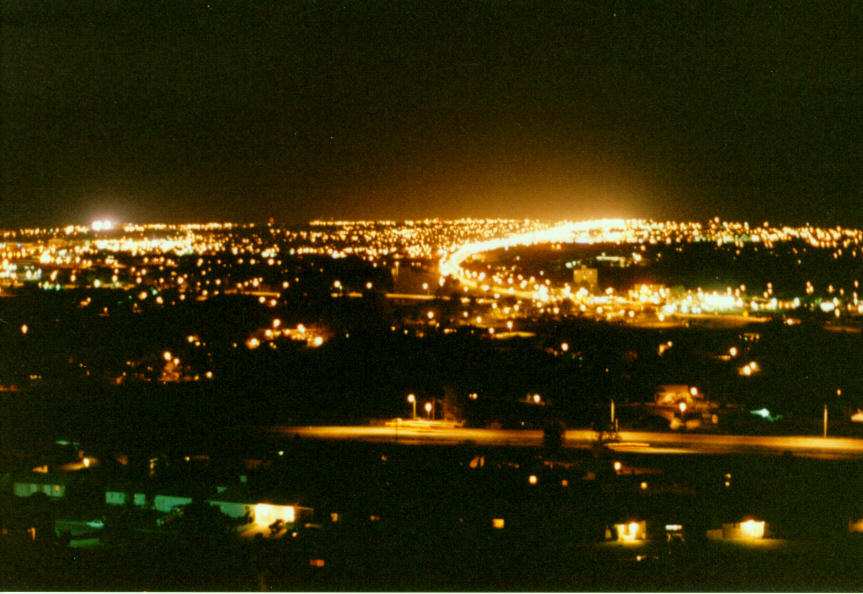

Read Part 1 here. Read Part 2 here. Recently, my wife and I have been looking into a potential job opportunity in Helena. While I haven’t been interviewed yet, it has given us the opportunity to explore what moving back to Montana would look like. We have visited Kalispell, which has grown to be massive…

Category: Great Falls

Great Falls: One Young Person’s View, Part 2

Read Part 1 here. When I graduated high school in 2015, I left Great Falls for the Army National Guard, and spent a year in South Carolina, Georgia, and Virginia, before coming back to Montana in 2016. In 2016, I spent a year driving school buses with Big Sky Bus Lines and trying to figure…

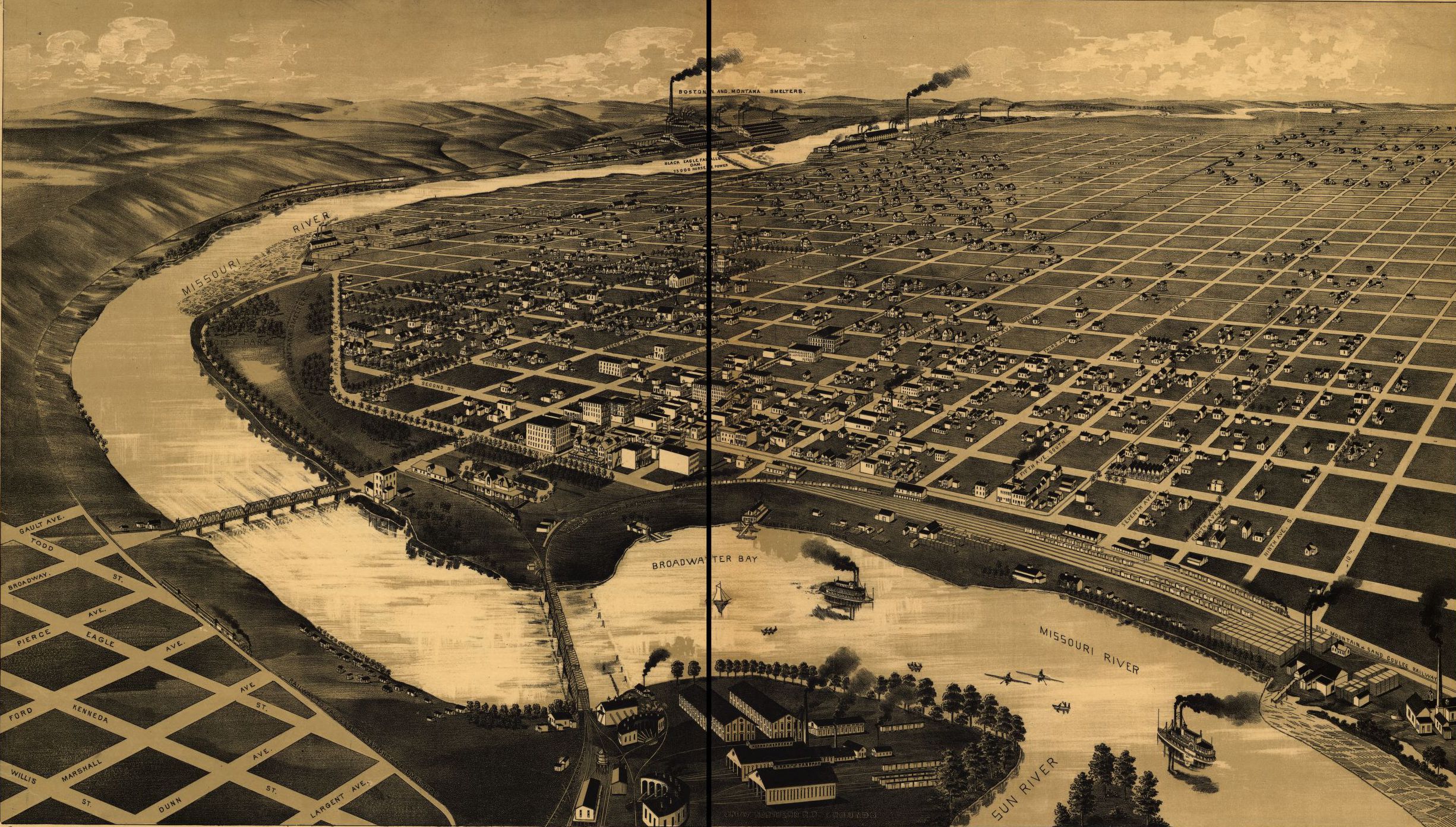

Great Falls: One Young Person’s View, Part 1

I know many of us have been there when we were young: I can’t wait to leave my hometown! I remember being a young teenager thinking that Great Falls was boring. However, when I turned sixteen, I discovered hunting and fishing—or generally speaking: the outdoors. Suddenly, Great Falls wasn’t so bad. I remember the best…

A Great Falls To Bozeman Eye-Opener

Last week I took a trip to Bozeman, MT and spent a couple of days in the area. Wow, talk about an eye-opening experience! I hadn’t been there in a good many years and I assumed it was pretty much the same Bozeman I knew from back in the day and have since heard about:…

Reflections On Great Falls And Cascade County

I am 63 years old and a lifelong intermittent resident of Montana and Great Falls. I have most all of my immediate family stretching from Conrad to Fort Benton and everything in between. I also have other family members in other parts of Montana. Every time I have moved back to Great Falls after being…

Sleight Of Hand?: Something Stinks In Great Falls Park District Number 1

As I have chatted with folks around Great Falls over the past two weeks since the May 8th mail-in school district levy and Park District 1 election, folks have expressed some surprise that the school levy failed while the Park District proposal passed. I’ve wondered the same thing myself because the school levy was a…

The Who, What, And How Of The Great Falls Good Old Boys And Gals Club

A local good old boys and gals club does exist in good ol’ Great Falls, and it has real impact on our community. Despite those who yell that I am just being negative, the facts tell the story. Crony capitalism exists to some extent everywhere and at every level, including right here in Great Falls….

Little-Known Important Information For Great Falls Park District Voters

Did you know that if you own property in Great Falls but live outside the city limits you can still vote either for or against the new consolidated Park District 1 tax increase? I didn’t know that very significant piece of information and I’ve been a voter here for decades. Someone asked me about it…

Eggselent Observations And Questions

Editor’s note: The following is a piece from one of our readers who is a local consumer, Jo Russell. We thought it was pretty interesting and hope you do too. Just curious if anyone knows why… Last week, a friend told me that the eggs she preferred to buy at a local supermarket had increased…

The Whole Truth

Are we getting the whole truth about the $13.9 million in new levies that the Great Falls Public School District ($1.348 million) and the City of Great Falls ($12.6 million) wants us to approve? And if we, the taxpayers, don’t approve them will that cause the dire consequences listed in their distributed promotional materials? Okay…