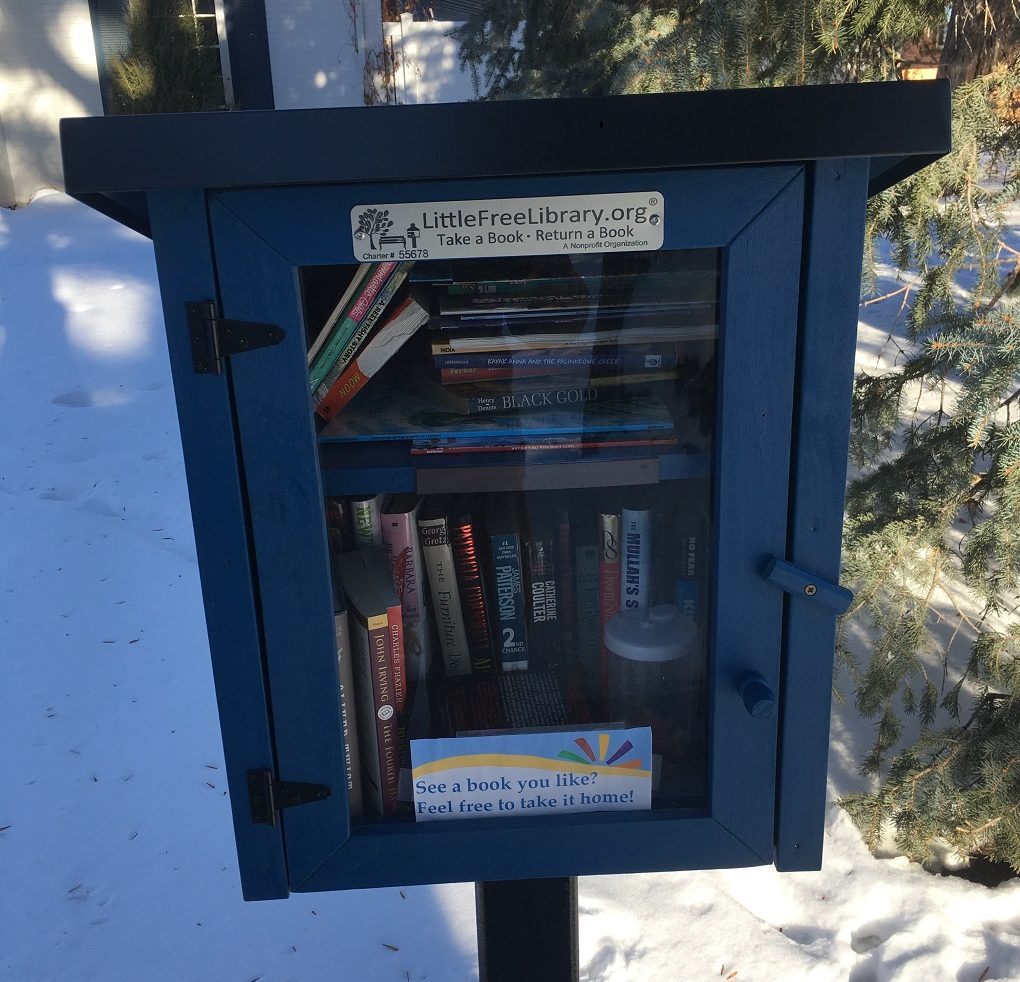

Have you seen the little wooden houses on posts in front yards around town? They look kind of like bird houses with a glass door on the front. Those are Little Free Library boxes most likely. What is a Little Free Library? “Little Free Library is a nonprofit organization that inspires a love of reading,…

Missing A Few Pieces Of The Puzzle

Mr. Cahill’s recent piece, “Promises Made and Promises Kept” in response to a November 26, 2017 post, “Why is Great Falls Tax Money Leaving Great Falls?” accurate? Mr. Cahill’s explanation of the results of the Great Falls School District’s use of taxpayer’s dollars appears on the surface to be factual, but a few pieces of…

An Unbiased Zoning Board Of Adjustments

This week, the Cascade County Commission requested a list of anyone who has submitted a letter during the public comment period (or who has made a public comment regarding the Madison Food Park Slaughterhouse) as they consider two Zoning Board of Adjustment candidates. Commissioner Weber stated that anyone who made a public statement would likely…

PROMISES MADE AND PROMISES KEPT

Phil Faccenda recently invited me to respond to a recent blog post on E-City Beat and subsequent comments regarding the selection of an architectural firm for the design of the Great Falls High School addition and renovation and a claim that because of that decision $37 million in taxpayer money left Great Falls. I am…

Happy New Year!

Here’s hoping everyone had a wonderful holiday season and wishing all a marvelous, prosperous 2018. We look forward to continuing our mission to publish great content about our city, state and region in the coming year. Stay tuned this week for a very interesting and informative piece written by Great Falls Public School District board…

Local City And County Board Openings

There are a couple of local government boards with fast approaching application deadlines readers should be aware of (and might be interested in applying for) – The Great Falls Ethics Committee and the Cascade County Zoning Board of Adjustments. The newly created City Ethics Committee is seeking three members to serve three, two and one…

Principles Or Politics

A couple of months ago during the Great Falls City Commission campaign, I posted a Facebook request for then candidate Mary Moe calling for her to provide voters with a definitive position on historic monuments and references to local figures. The Columbus Day post was recently reposted to E-City Beat. I think it is safe…

Columbus Day: Will The REAL Mary Moe Please Stand Up?

Editors note: the following comments originally appeared on Facebook and in the Great Falls Tribune in early October, 2017 – prior to the Great Falls municipal election. Subsequently Ms. Moe has been elected to the City Commission. We are publishing the letter here as a prelude to a follow-up piece coming soon. Stay tuned. Like…

How Are We To Select A Great Falls Ethics Committee?

Let’s say you needed to find a watchdog because your henhouse was recently raided by some foxes. Would you go to the local fox den and ask the occupants therein, some with feathers still clinging to their little chins, to select the best watchdog to keep an eye on your cluckers? The Great Falls City…

GREAT FALLS CITY STAFF, ZONING BOARD AT ODDS OVER FOX FARM DEVELOPMENT

An interesting new wrinkle in a Fox Farm area planned unit development (PUD) for a hotel complex has city staff at odds with the city planning advisory board/ zoning commission. The proposed ordinance covering the change, Ordinance 3182, comes to the city commission with a negative recommendation from city staff and a positive recommendation from…