I am 63 years old and a lifelong intermittent resident of Montana and Great Falls. I have most all of my immediate family stretching from Conrad to Fort Benton and everything in between. I also have other family members in other parts of Montana. Every time I have moved back to Great Falls after being…

Category: Great Falls

Sleight Of Hand?: Something Stinks In Great Falls Park District Number 1

As I have chatted with folks around Great Falls over the past two weeks since the May 8th mail-in school district levy and Park District 1 election, folks have expressed some surprise that the school levy failed while the Park District proposal passed. I’ve wondered the same thing myself because the school levy was a…

The Who, What, And How Of The Great Falls Good Old Boys And Gals Club

A local good old boys and gals club does exist in good ol’ Great Falls, and it has real impact on our community. Despite those who yell that I am just being negative, the facts tell the story. Crony capitalism exists to some extent everywhere and at every level, including right here in Great Falls….

Little-Known Important Information For Great Falls Park District Voters

Did you know that if you own property in Great Falls but live outside the city limits you can still vote either for or against the new consolidated Park District 1 tax increase? I didn’t know that very significant piece of information and I’ve been a voter here for decades. Someone asked me about it…

Eggselent Observations And Questions

Editor’s note: The following is a piece from one of our readers who is a local consumer, Jo Russell. We thought it was pretty interesting and hope you do too. Just curious if anyone knows why… Last week, a friend told me that the eggs she preferred to buy at a local supermarket had increased…

The Whole Truth

Are we getting the whole truth about the $13.9 million in new levies that the Great Falls Public School District ($1.348 million) and the City of Great Falls ($12.6 million) wants us to approve? And if we, the taxpayers, don’t approve them will that cause the dire consequences listed in their distributed promotional materials? Okay…

Park Pickpocket

Did you know that the City of Great Falls is spending Great Falls taxpayers money to promote a ballot measure to, wait for it…get more of Great Falls taxpayers money! The Great Falls Parks and Recreation Department’s yearly Summer Guide, paid for with our tax dollars, came out today in the Tribune and last week…

Loser Out

In the midst of a conflicts of interest plague, Great Falls seems relegated to loser out status in the tournament of economic development in our state. Why has Great Falls lost population, manufacturing jobs and a brighter outlook for the future? Certainly, Great Falls Development Authority chief Brett Doney’s stated solution to the problem: “we…

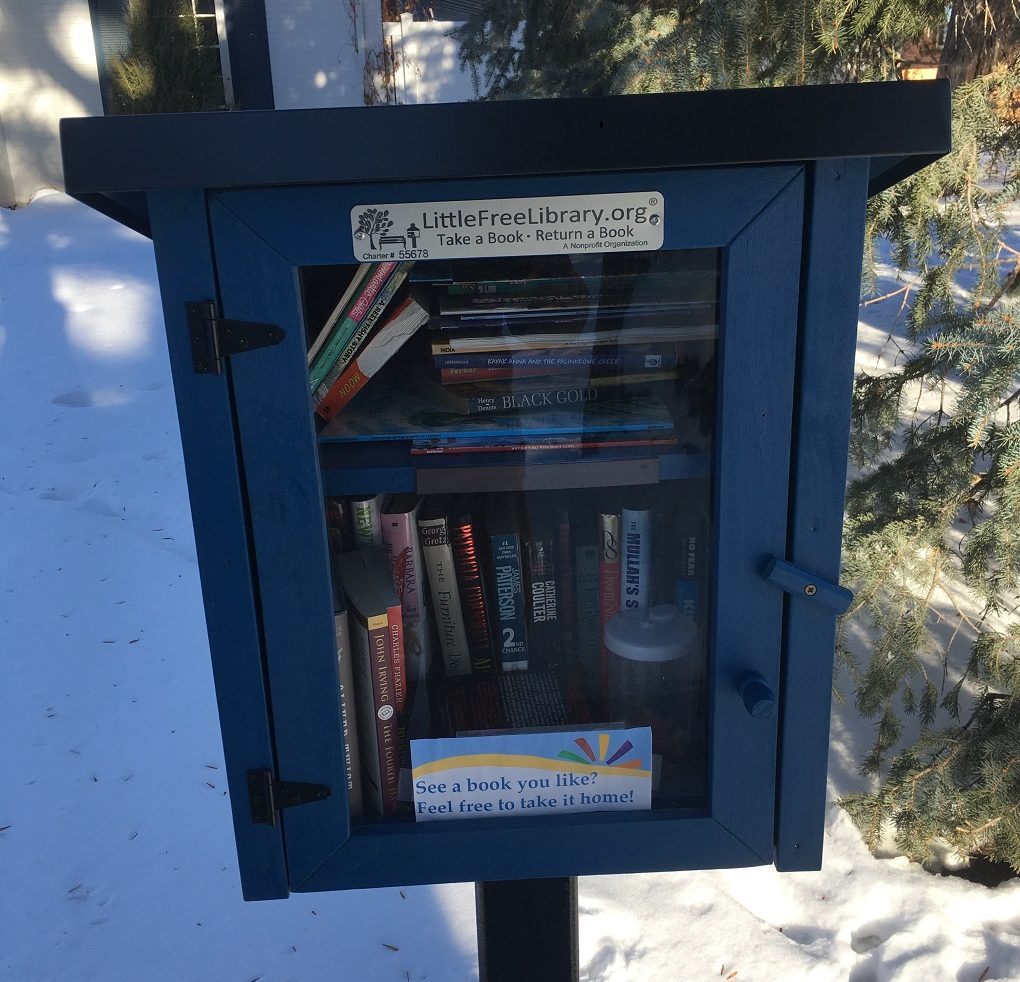

Little Free Library Is A Whole Lot Of Cool

Have you seen the little wooden houses on posts in front yards around town? They look kind of like bird houses with a glass door on the front. Those are Little Free Library boxes most likely. What is a Little Free Library? “Little Free Library is a nonprofit organization that inspires a love of reading,…

Local City And County Board Openings

There are a couple of local government boards with fast approaching application deadlines readers should be aware of (and might be interested in applying for) – The Great Falls Ethics Committee and the Cascade County Zoning Board of Adjustments. The newly created City Ethics Committee is seeking three members to serve three, two and one…